Forex Knowledge 7 FEB 2014 currency Report.

EQUITIES

The markets are in a pullback mode now. In the next couple sessions, it should be clear if it is the expected pullback only before resumption of the downtrend or it is something more like a true reversal.

Dow (15628.53, +1.22%) had its best day this year on the back of a drop in applications for US unemployment insurance and good earnings. The much awaited Jobs data today may determine the next direction. A good data may extend the rally till 15950-16000 but selling pressure may return there. It has shown the first sign of losing momentum since the 2009 bottom and opens the door towards 14700-900 initially with short rallies interrupting the fall.

Nikkei (14404.01, +1.76%), despite a bounce from our support of 14000 now, may face selling pressure any time till 14850-15100 as it remains in a bear market. Below 14000, our targets of 13700 and 13200 may be achieved quickly.

Shanghai (2028.42, -0.23%) opens in a flat note after the long New Year holiday. It needs to rise past 2060-80 and then 2120-30 to break the longer term downtrend it is trapped in.

Dax (9116.32, -0.13%) broke out of a Triangle pattern on the upside but the medium term downtrend remains unchanged. At the higher levels, the bears are waiting at 9300-60. The maximum upside looks capped to 9500-50.

Nifty (6036.30, +0.23%) faced sharp rejection from our resistance of 6050-75 but it may break above that on strong global cues to face the old major hurdle at 6100-10. The bulls will face an acid test at those levels and caution is warranted. The price action there may determine the direction for the rest of the week. Please note that the structural damage is extensive and may not be repaired in 2-3 days’ rally.

COMMODITIES

Gold (1260.31) remained stable fluctuating within the 1253-1274 regions and may continue so for a few sessions. A break above 1274.42 could take it higher to 1295-1300 in the coming weeks.

Silver (19.845) is stable and is testing resistance near current levels which if holds may take it down to 19 else we may see a higher target of 20-20.5 in the near term. Overall it is in a long term downtrend.

Copper (3.2435) has risen sharply as the trend support at 3.1775 holds well. A rise past 3.25 may take it higher to 3.35 in the near term.

Brent (107.35) showed a sharp rise yesterday from the trend support near 106.15. We may now see a rise towards 108 and even 110 in the longer run.

Nymex WTI (97.64) remains ranged with no major movement for now and may target 98-98.25 in the near term. A rise past 98.25 may take it higher towards 100-102.

CURRENCIES

The Dollar Index (80.8750) has not been able to break the higher end of the 3 month long range of 79.70-81.50 in a repeat show of the same movie though remaining in a short term uptrend inside the broader range. A successful break above 81.50 may take it sharply to 81.85-90 and then 82.50-60. The US Jobs data tonight may provide a directional move.

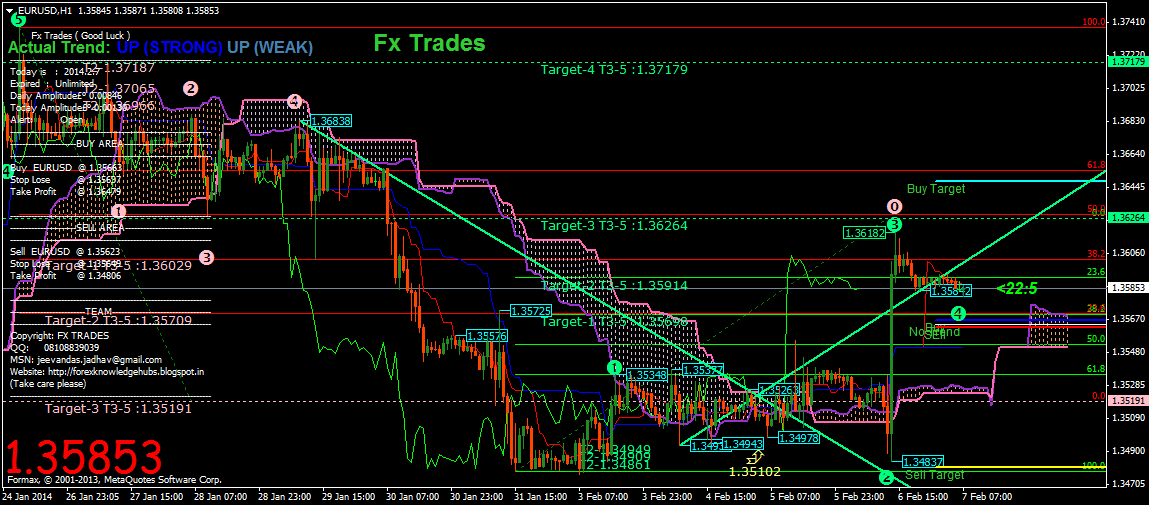

The Euro (1.3591) is trading inside a contracting Wedge pattern in a show of decreasing bearish momentum. It must break above 1.3660-90 to reverse to an uptrend but the lack of momentum on the downside keeps the possibility of a sharp rally any day alive and that’s enough to keep the currently dominant bears on their toes.

Dollar-Yen (102.04) has bounced from the September 2013 top which may extend to 102.40 but staying below 102.50-103.50, we may still see a journey towards 98 in the coming days.

The Euro-Yen Cross (138.64) bounced from a major monthly trendline support at 136.20 to break above 138 to negate any immediate fall and now may extend the rally to the strong resistance zone of 139.60-70 and then 140.40.

Pound (1.6322) is moving sideways with no strength visible till now but keeping the low of 1.6250 or even 1.62 it may keep the medium term uptrend intact and bounce higher. On the other hand, a break of 1.6170 would open a huge downside.

The Aussie (0.8934) is struggling near the resistance zone of 0.90-0.91 after bouncing back sharply from our support zone of 08680-0.87. A bigger rally will be signaled on a break above 0.90-0.91. A failure to break above 0.90-0.91 may bring back the weakness.

Dollar-Rupee (62.37) may open lower near the support of 62.20-25 today which may negate the immediate bullish possibilities. Below 62.26-34, Dollar Rupee may remain weak and fall to 62.10 and then 61.70.

INTEREST RATES

The US 10Yr (2.70%) has turned around after seeing a low of 2.59% on 3rd February 2013. We see that the US yield Curve is seeing a steep rise as indicated by the rise in the 10Yr-5Yr yield differential (1.18%) and the 30Yr-10Yr yield differential (0.97%) suggesting an increase in the US yields in the further term. A rise past the resistance near 2.75% of the 10Yr yield and we may see it going further up toward 3.00%.

The German 10Yr (1.69%) saw a rise after the ECB refrained from cutting its key interest rates, stating that measures will be taken if the inflation outlook worsens. It 10Yr has seen a slight bounce from the support near 1.62%-1.63% and it may target 1.75% in the near term.

Similarly the BOE also maintained its benchmark interest rates at 0.50%. The UK 10Yr (2.74%) rose after the announcement and it may target 2.80% if it is able to rise past 2.75%.

The Japan 10Yr (0.61%) is stable and has been trading in the 0.60% - 0.62% range for the last two weeks. We may see a drop to the support near 0.50% if it is unable to move past 0.65%.

The Indian 10Yr GOI yield (8.72%) remained stable. It is ranged between 8.65%-8.85% for now and is expected to remain in that range for the next few days.

DATA TODAY9:30 GMT or 15:00 IST UK Trade Balance

...Expected -9.30 £ Bln ...Previous -9.44 £ Bln

13:30 GMT or 19:00 IST US NFP

...Expected 185 K ... Previous 74 K

13:30 GMT or 19:00 IST US Unemployment Rate

...Expected 6.7 % ... Previous 6.7 %

US Debt Ceiling - - -

13:30 GMT or 19:00 IST CA Labour Force

...Previous -45.90 K

DATA YESTERDAY

Australia Trade Balance

...Expected -0.27 $Bln ...Previous 0.08 $Bln - ...Actual 0.47 $Bln

BOE Mtg

... Expected 0.50 % ...Previous 0.50 % ...Actual 0.50%

ECB Meeting

...Expected 0.25 % ...Previous 0.25 % ...Actual 0.25 %

US Trade Balance

...Expected -35.80 $ Bln ...Previous -38.78 $ Bln ...Actual -37.45 $ Bln

CA PMI

...Expected 51.30 ...Previous 46.30 ...Actual 56.80

EQUITIES

The markets are in a pullback mode now. In the next couple sessions, it should be clear if it is the expected pullback only before resumption of the downtrend or it is something more like a true reversal.

Dow (15628.53, +1.22%) had its best day this year on the back of a drop in applications for US unemployment insurance and good earnings. The much awaited Jobs data today may determine the next direction. A good data may extend the rally till 15950-16000 but selling pressure may return there. It has shown the first sign of losing momentum since the 2009 bottom and opens the door towards 14700-900 initially with short rallies interrupting the fall.

Nikkei (14404.01, +1.76%), despite a bounce from our support of 14000 now, may face selling pressure any time till 14850-15100 as it remains in a bear market. Below 14000, our targets of 13700 and 13200 may be achieved quickly.

Shanghai (2028.42, -0.23%) opens in a flat note after the long New Year holiday. It needs to rise past 2060-80 and then 2120-30 to break the longer term downtrend it is trapped in.

Dax (9116.32, -0.13%) broke out of a Triangle pattern on the upside but the medium term downtrend remains unchanged. At the higher levels, the bears are waiting at 9300-60. The maximum upside looks capped to 9500-50.

Nifty (6036.30, +0.23%) faced sharp rejection from our resistance of 6050-75 but it may break above that on strong global cues to face the old major hurdle at 6100-10. The bulls will face an acid test at those levels and caution is warranted. The price action there may determine the direction for the rest of the week. Please note that the structural damage is extensive and may not be repaired in 2-3 days’ rally.

COMMODITIES

Gold (1260.31) remained stable fluctuating within the 1253-1274 regions and may continue so for a few sessions. A break above 1274.42 could take it higher to 1295-1300 in the coming weeks.

Silver (19.845) is stable and is testing resistance near current levels which if holds may take it down to 19 else we may see a higher target of 20-20.5 in the near term. Overall it is in a long term downtrend.

Copper (3.2435) has risen sharply as the trend support at 3.1775 holds well. A rise past 3.25 may take it higher to 3.35 in the near term.

Brent (107.35) showed a sharp rise yesterday from the trend support near 106.15. We may now see a rise towards 108 and even 110 in the longer run.

Nymex WTI (97.64) remains ranged with no major movement for now and may target 98-98.25 in the near term. A rise past 98.25 may take it higher towards 100-102.

CURRENCIES

The Dollar Index (80.8750) has not been able to break the higher end of the 3 month long range of 79.70-81.50 in a repeat show of the same movie though remaining in a short term uptrend inside the broader range. A successful break above 81.50 may take it sharply to 81.85-90 and then 82.50-60. The US Jobs data tonight may provide a directional move.

The Euro (1.3591) is trading inside a contracting Wedge pattern in a show of decreasing bearish momentum. It must break above 1.3660-90 to reverse to an uptrend but the lack of momentum on the downside keeps the possibility of a sharp rally any day alive and that’s enough to keep the currently dominant bears on their toes.

Dollar-Yen (102.04) has bounced from the September 2013 top which may extend to 102.40 but staying below 102.50-103.50, we may still see a journey towards 98 in the coming days.

The Euro-Yen Cross (138.64) bounced from a major monthly trendline support at 136.20 to break above 138 to negate any immediate fall and now may extend the rally to the strong resistance zone of 139.60-70 and then 140.40.

Pound (1.6322) is moving sideways with no strength visible till now but keeping the low of 1.6250 or even 1.62 it may keep the medium term uptrend intact and bounce higher. On the other hand, a break of 1.6170 would open a huge downside.

The Aussie (0.8934) is struggling near the resistance zone of 0.90-0.91 after bouncing back sharply from our support zone of 08680-0.87. A bigger rally will be signaled on a break above 0.90-0.91. A failure to break above 0.90-0.91 may bring back the weakness.

Dollar-Rupee (62.37) may open lower near the support of 62.20-25 today which may negate the immediate bullish possibilities. Below 62.26-34, Dollar Rupee may remain weak and fall to 62.10 and then 61.70.

INTEREST RATES

The US 10Yr (2.70%) has turned around after seeing a low of 2.59% on 3rd February 2013. We see that the US yield Curve is seeing a steep rise as indicated by the rise in the 10Yr-5Yr yield differential (1.18%) and the 30Yr-10Yr yield differential (0.97%) suggesting an increase in the US yields in the further term. A rise past the resistance near 2.75% of the 10Yr yield and we may see it going further up toward 3.00%.

The German 10Yr (1.69%) saw a rise after the ECB refrained from cutting its key interest rates, stating that measures will be taken if the inflation outlook worsens. It 10Yr has seen a slight bounce from the support near 1.62%-1.63% and it may target 1.75% in the near term.

Similarly the BOE also maintained its benchmark interest rates at 0.50%. The UK 10Yr (2.74%) rose after the announcement and it may target 2.80% if it is able to rise past 2.75%.

The Japan 10Yr (0.61%) is stable and has been trading in the 0.60% - 0.62% range for the last two weeks. We may see a drop to the support near 0.50% if it is unable to move past 0.65%.

The Indian 10Yr GOI yield (8.72%) remained stable. It is ranged between 8.65%-8.85% for now and is expected to remain in that range for the next few days.

DATA TODAY9:30 GMT or 15:00 IST UK Trade Balance

...Expected -9.30 £ Bln ...Previous -9.44 £ Bln

13:30 GMT or 19:00 IST US NFP

...Expected 185 K ... Previous 74 K

13:30 GMT or 19:00 IST US Unemployment Rate

...Expected 6.7 % ... Previous 6.7 %

US Debt Ceiling - - -

13:30 GMT or 19:00 IST CA Labour Force

...Previous -45.90 K

DATA YESTERDAY

Australia Trade Balance

...Expected -0.27 $Bln ...Previous 0.08 $Bln - ...Actual 0.47 $Bln

BOE Mtg

... Expected 0.50 % ...Previous 0.50 % ...Actual 0.50%

ECB Meeting

...Expected 0.25 % ...Previous 0.25 % ...Actual 0.25 %

US Trade Balance

...Expected -35.80 $ Bln ...Previous -38.78 $ Bln ...Actual -37.45 $ Bln

CA PMI

...Expected 51.30 ...Previous 46.30 ...Actual 56.80

No comments:

Post a Comment