Forex Knowledge 5 FEB 2014 currency Report.

EQUITIES

Dow (15445.24, +0.47%) took a pause for a day but 15650-700 may resist any bounce for now. It has shown the first sign of losing momentum since the 2009 bottom and opens the door towards 14700-900 initially with short rallies interrupting the fall. Equality with the 2011 correction gives a medium term target of 14100-13900 but even 13400 might be in cards now.

Nikkei (14144.29, +0.97%), in a confirmed bear market now, is testing our support of 14000 now. All rallies till 14850-15100 will face selling pressure. Below 14000, our targets of 13700 and 13200 may be achieved quickly.

Shanghai (2033.08, -0.27%) remains closed till 6th February. It is among the better performers in this turmoil as it has already been in a major bear market for while now and has been beaten a lot already much before the other markets came under bear grip. That said, it needs to rise past 2080-90 and then 2150 to break the longer term downtrend it is trapped in.

Dax (9127.91, -0.64%) is still not showing any bottoming sign with bears waiting at 9300-60 levels on the upside. The continuation of this firm downtrend may take it to 8950-8850 now.

Nifty (6000.90, -0.01%) shows an intention to bounce back as it has recovered all its intraday losses and has managed to close flat after almost achieving our last target of 5920. Only a sustained move above 6020 may signal a larger retracement. Please note that the structural damage is extensive and may not be repaired in 2-3 days’ rally.

COMMODITIES

Gold (1255.00) remains ranged while the resistance near 1276.8 still holds well. It may consolidate in the 1274-1235 region while within the near term uptrend. A break above 1274.42 could take it higher to 1295-1300 in the coming weeks.

Silver (19.588) has risen and while above 19.42 it may target 19.8-20 and even resistance near 20.5 in the coming weeks. It has been trading below 20.5 since Nov’13 and may take some time to rise past 20.5.

Copper (3.2025) has bounced from 3.1775 in line with expectation and may target 3.35 in the coming sessions if it rises past 3.25.

Brent (105.880) is trading low and has been fluctuating in the 105.35-106.5 regions since the last 3-sessions. It is now trading just above the trend support near 105.66 from where it may bounce back to 108. Else a break below 105.60 may take it down to the next support near 104.48-104.8.

Nymex WTI (97.64) has risen and is testing resistance just above current levels. A further rise may take it higher towards 98-100. Overall it is in an uptrend since Mar’09.

CURRENCIES

The Dollar Index (81.10) has not been able to break the higher end of the 3 month long range of 79.70-81.50 in a repeat show of the same movie though remaining in a short term uptrend inside the broader range. A successful break above 81.50 may take it to 81.85-90 and then 82.50-60.

The Euro (1.3517) is testing the resistance zone of 1.3540-75 now after it signaled a move towards 1.33 and even 1.31. The bearish momentum may increase below 1.3450 while any possible bounce may face good selling pressure.

Dollar-Yen (101.28) is firmly trading below the bull market defining support level of 101.50-101.90 to signal the bear market. Staying below 102.50-103.50, we may see a journey towards 98 in the coming days.

The Euro-Yen Cross (136.95) achieved our second target of 137 too and got closer to the major support of 135. No sign of strength is visible yet and all rallies may face good selling pressure.

Pound (1.6327) could not escape this carnage and weakened to 1.63, below which a fall to 1.6175-1.62 is possible. A break of 1.617 would open a huge downside.

The Aussie (0.8890), one of the earliest and biggest underperformers among the major pairs, bounced to 0.8950 from the major support of 0.87 but must go above 0.90 to make it meaningful. Otherwise, it could be in danger of seeing a meltdown towards 0.87 and then 0.85.

Dollar-Rupee (62.5250) may open lower near 62.30-35 today. The bullish possibilities survive till 62.26-34 which would require a break above 62.81 later. Below 62.26, Dollar Rupee may turn weak and may fall to 62.10 and then 61.70.

INTEREST RATES

The US 10Yr (2.61%) saw a slight rise before the Employment data that is to come out today. It is now targeting support near 2.50%.

The German 10Yr (1.65%) saw a decline ahead of the ECB Meeting tomorrow and is testing the support at current levels. A bounce from the support and we may see it going up to 1.75%-1.80%. The German-US 10Yr spread (-0.96%) is up and is near our target of -0.90%. The word all around the markets is that the ECB will cut its key interest rates to counter deflation fears.

The Japan 10Yr (0.61%) is stable and is trading in the range of 0.60%-0.65%. We may now see it drop to target support near 0.50%. The US-Japan 10Yr yield spread (2.00%) remained stable and can target 1.95%.

The Indian 10Yr GOI yield (8.68%) fell below our targeted range of 8.70% - 8.90%. We can expect the yield to drop further to 8.50%.

DATA TODAY10:00 GMT or 15:30 IST EU Retail Sales

...Expected -0.70 % ...Previous 1.34 %

13:15 GMT or 18:45 IST US ADP Emp

...Expected 191 K ...Previous 238 K

DATA YESTERDAY

RBA Meeting

...Expected 2.50 % ...Previous 2.50 % ...Actual 2.50 %

EUR/JPY

EUR/USD

Trading range: 1.3535 – 1.3460

Trend: Down

Sell at 1.3525 SL 1.3557 TP 1.3472

USD/CHF

Trading range: 0.9020 – 0.9100

Trend: Up

Buy at 0.9033 SL 0.9001 TP 0.9088

GBP/USD

Trading range: 1.6355 – 1.6260

Trend: Strong Down

Sell at 1.6342 SL 1.6374 TP 1.6270

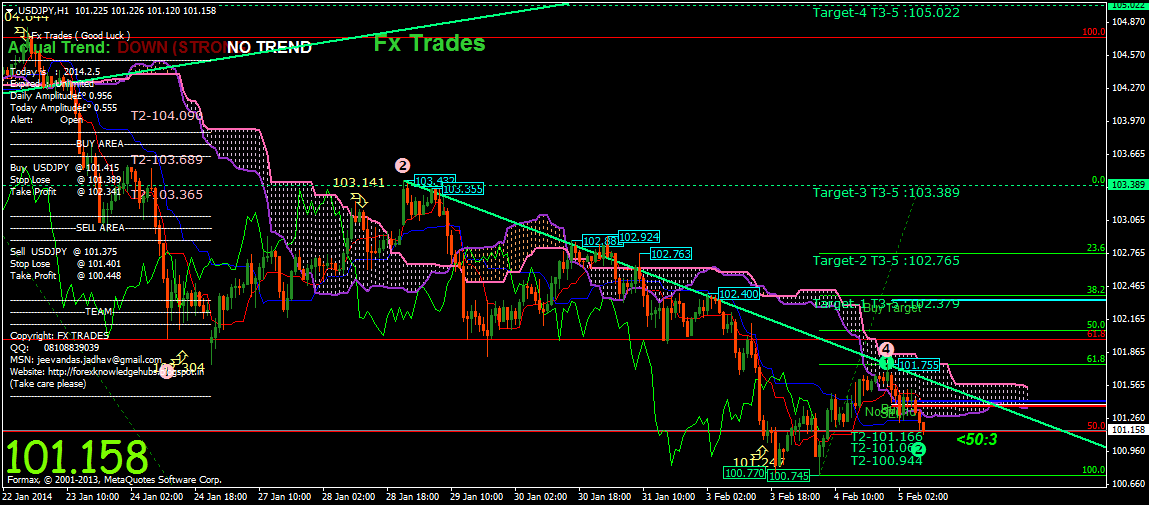

USD/JPY

Trading range: 101.65 – 100.75

Trend: Strong Down

Sell at 101.53 SL 101.85 TP 100.81

The current support/resistance levels are:

EUR/USD 1.3463, 1.3443, 1.3410 – 1.3587, 1.3607, 1.3640

USD/JPY 100.82, 100.54, 100.10 – 102.24, 102.52, 102.96

GBP/USD 1.6264, 1.6236, 1.6192 – 1.6420, 1.6448, 1.6492

USD/CHF 0.8967, 0.8946, 0.8912 – 0.9099, 0.9120, 0.9154

EQUITIES

Dow (15445.24, +0.47%) took a pause for a day but 15650-700 may resist any bounce for now. It has shown the first sign of losing momentum since the 2009 bottom and opens the door towards 14700-900 initially with short rallies interrupting the fall. Equality with the 2011 correction gives a medium term target of 14100-13900 but even 13400 might be in cards now.

Nikkei (14144.29, +0.97%), in a confirmed bear market now, is testing our support of 14000 now. All rallies till 14850-15100 will face selling pressure. Below 14000, our targets of 13700 and 13200 may be achieved quickly.

Shanghai (2033.08, -0.27%) remains closed till 6th February. It is among the better performers in this turmoil as it has already been in a major bear market for while now and has been beaten a lot already much before the other markets came under bear grip. That said, it needs to rise past 2080-90 and then 2150 to break the longer term downtrend it is trapped in.

Dax (9127.91, -0.64%) is still not showing any bottoming sign with bears waiting at 9300-60 levels on the upside. The continuation of this firm downtrend may take it to 8950-8850 now.

Nifty (6000.90, -0.01%) shows an intention to bounce back as it has recovered all its intraday losses and has managed to close flat after almost achieving our last target of 5920. Only a sustained move above 6020 may signal a larger retracement. Please note that the structural damage is extensive and may not be repaired in 2-3 days’ rally.

COMMODITIES

Gold (1255.00) remains ranged while the resistance near 1276.8 still holds well. It may consolidate in the 1274-1235 region while within the near term uptrend. A break above 1274.42 could take it higher to 1295-1300 in the coming weeks.

Silver (19.588) has risen and while above 19.42 it may target 19.8-20 and even resistance near 20.5 in the coming weeks. It has been trading below 20.5 since Nov’13 and may take some time to rise past 20.5.

Copper (3.2025) has bounced from 3.1775 in line with expectation and may target 3.35 in the coming sessions if it rises past 3.25.

Brent (105.880) is trading low and has been fluctuating in the 105.35-106.5 regions since the last 3-sessions. It is now trading just above the trend support near 105.66 from where it may bounce back to 108. Else a break below 105.60 may take it down to the next support near 104.48-104.8.

Nymex WTI (97.64) has risen and is testing resistance just above current levels. A further rise may take it higher towards 98-100. Overall it is in an uptrend since Mar’09.

CURRENCIES

The Dollar Index (81.10) has not been able to break the higher end of the 3 month long range of 79.70-81.50 in a repeat show of the same movie though remaining in a short term uptrend inside the broader range. A successful break above 81.50 may take it to 81.85-90 and then 82.50-60.

The Euro (1.3517) is testing the resistance zone of 1.3540-75 now after it signaled a move towards 1.33 and even 1.31. The bearish momentum may increase below 1.3450 while any possible bounce may face good selling pressure.

Dollar-Yen (101.28) is firmly trading below the bull market defining support level of 101.50-101.90 to signal the bear market. Staying below 102.50-103.50, we may see a journey towards 98 in the coming days.

The Euro-Yen Cross (136.95) achieved our second target of 137 too and got closer to the major support of 135. No sign of strength is visible yet and all rallies may face good selling pressure.

Pound (1.6327) could not escape this carnage and weakened to 1.63, below which a fall to 1.6175-1.62 is possible. A break of 1.617 would open a huge downside.

The Aussie (0.8890), one of the earliest and biggest underperformers among the major pairs, bounced to 0.8950 from the major support of 0.87 but must go above 0.90 to make it meaningful. Otherwise, it could be in danger of seeing a meltdown towards 0.87 and then 0.85.

Dollar-Rupee (62.5250) may open lower near 62.30-35 today. The bullish possibilities survive till 62.26-34 which would require a break above 62.81 later. Below 62.26, Dollar Rupee may turn weak and may fall to 62.10 and then 61.70.

INTEREST RATES

The US 10Yr (2.61%) saw a slight rise before the Employment data that is to come out today. It is now targeting support near 2.50%.

The German 10Yr (1.65%) saw a decline ahead of the ECB Meeting tomorrow and is testing the support at current levels. A bounce from the support and we may see it going up to 1.75%-1.80%. The German-US 10Yr spread (-0.96%) is up and is near our target of -0.90%. The word all around the markets is that the ECB will cut its key interest rates to counter deflation fears.

The Japan 10Yr (0.61%) is stable and is trading in the range of 0.60%-0.65%. We may now see it drop to target support near 0.50%. The US-Japan 10Yr yield spread (2.00%) remained stable and can target 1.95%.

The Indian 10Yr GOI yield (8.68%) fell below our targeted range of 8.70% - 8.90%. We can expect the yield to drop further to 8.50%.

DATA TODAY10:00 GMT or 15:30 IST EU Retail Sales

...Expected -0.70 % ...Previous 1.34 %

13:15 GMT or 18:45 IST US ADP Emp

...Expected 191 K ...Previous 238 K

DATA YESTERDAY

RBA Meeting

...Expected 2.50 % ...Previous 2.50 % ...Actual 2.50 %

EUR/JPY

EUR/USD

Trading range: 1.3535 – 1.3460

Trend: Down

Sell at 1.3525 SL 1.3557 TP 1.3472

USD/CHF

Trading range: 0.9020 – 0.9100

Trend: Up

Buy at 0.9033 SL 0.9001 TP 0.9088

GBP/USD

Trading range: 1.6355 – 1.6260

Trend: Strong Down

Sell at 1.6342 SL 1.6374 TP 1.6270

USD/JPY

Trading range: 101.65 – 100.75

Trend: Strong Down

Sell at 101.53 SL 101.85 TP 100.81

The current support/resistance levels are:

EUR/USD 1.3463, 1.3443, 1.3410 – 1.3587, 1.3607, 1.3640

USD/JPY 100.82, 100.54, 100.10 – 102.24, 102.52, 102.96

GBP/USD 1.6264, 1.6236, 1.6192 – 1.6420, 1.6448, 1.6492

USD/CHF 0.8967, 0.8946, 0.8912 – 0.9099, 0.9120, 0.9154

No comments:

Post a Comment